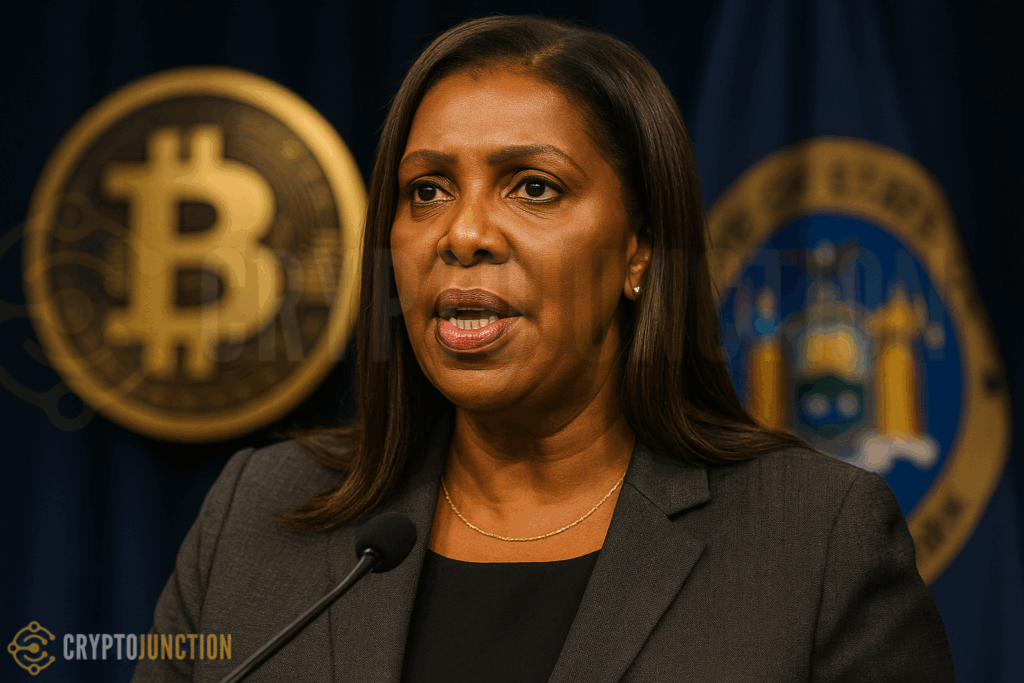

In a letter sent out on July 1, 2025, New York’s Attorney General Letitia James put forward the case that present stablecoin bills do not do enough to protect investors and the banking system. Specifically, she referenced the GENIUS Act and the STABLE Act.

Letitia James puts forth that these bills are missing key protections. Most notably, she points out the treatment of stablecoin issuers as traditional banks. Also, she says they should be required to have FDIC insurance and be put under bank level regulation. Furthermore, they should run digital identity verification for every transaction.

Letitia James Criticizes GENIUS, STABLE Acts

Both crypto bills are passing. The GENIUS Act broke through in the Senate with bipartisan support. Meanwhile, the STABLE Act is waiting for a House go-ahead. However, Letitia James reports that neither does what is needed. She uses the actions during the 2023 Silicon Valley Bank crisis as a turning point. This crisis saw USDC lose its peg, a critical moment Letitia James analyzed deeply.

Her demands include:

- FDIC protection for stablecoin holders

- Full banking compliance for issuers

- Compulsory digital ID technology to prevent illicit finance.

- Tighter fraud enforcement tools

She reports that, in their absence, stablecoins may cause financial instability and issues for consumers. Letitia James warns that this in turn will greatly impact ignored communities.

Warns of Systemic Crypto Risks

James is not a theorist in this case. Letitia James puts forth is the result of an extensive series of crypto enforcement actions. Her office has taken action by freezing $300,000 related to scams targeting Russian-speaking New Yorkers. Additionally, they recovered over $2 billion in past fraud cases.

The AG has taken a hard line, which has at times contradicted Letitia James and federal policymakers. In April, she called for a ban on crypto in retirement funds. She argued it poses a high risk and offers poor value.

Letitia James Pushes State-Level Action

With federal adoption unlikely, especially with President Trump backing the GENIUS Act, James may push her agenda via New York’s BitLicense framework. If passed, her proposal would reclassify stablecoins as full-scale banking products. Letitia James believes this would establish the world’s strictest crypto regulation. This is part of her strategy for strengthening local regulations.

While critics worry about less innovation, James puts first the issue of financial stability. She says Congress must not allow for unlimited crypto growth at the expense of the American banking system.

As we approach the $2 trillion mark for global stablecoin markets, James’ framework will define the next stage of digital finance. This may not align with what Washington wants. Letitia James continues to influence important financial legislation significantly.